How Many Working Days Are In A Year?

In the U.S., the average amount of working days in one year is 260.

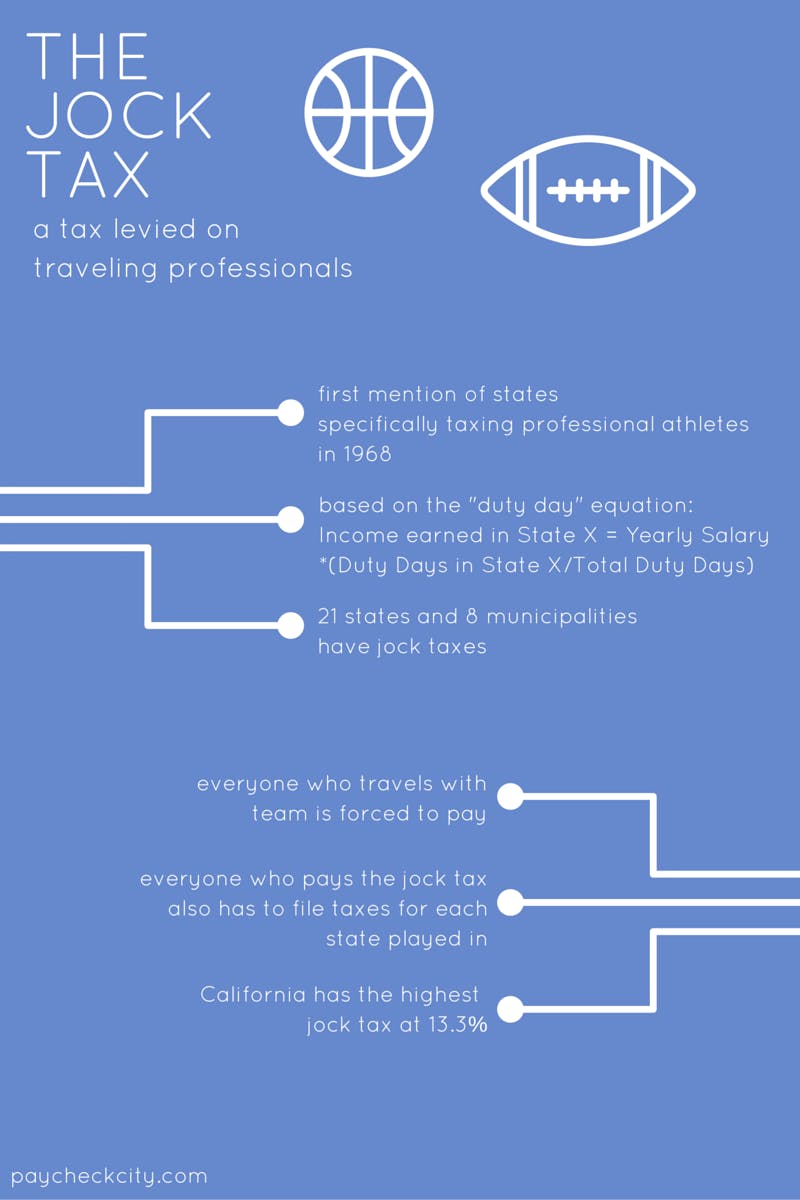

What is the Jock Tax?

The Jock Tax is a colloquial term for a tax imposed on traveling professionals. It got its nickname because all-star athletes are the most well-known “traveling professionals”, who also happen to have very public salaries.

In essence, this tax is a separate income tax an athlete most pay on top of their earnings and salary, based on where they're playing. Its official introduction to the world of sports is debated between 1968 and 1991. In 1968, California was faced with an appeal for taxes owed by a San Diego Charger who didn’t live in the state. In 1991, after the Los Angeles Lakers lost to the Chicago Bulls, California decided to tax Michael Jordan’s winnings specifically. California will once again take a pretty penny of whoever wins the NBA Finals this Sunday. Their jock tax rate is a whopping 13.3%.

Below is an infographic with more info of this tax.

In the U.S., the average amount of working days in one year is 260.

Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. Here are four mistakes small business owners should avoid.

Celebrate National Payroll Week 2024, September 2-6! Join the fun, take the survey for a chance to win big, and honor payroll pros. Discover the joy of getting paid and learn more about this year’s theme: "America Works Because We’re Working for America ®."