How Many Working Days Are In A Year?

In the U.S., the average amount of working days in one year is 260.

Unlock the secrets of your 2023 bonus taxes with our guide, and use our Bonus Pay Percent Calculator for an instant breakdown of your take-home pay.

The holidays are here, and so is the anticipation of your 2023 bonus. But before you celebrate, let's unravel the mystery of bonus taxes. Understanding how your bonus is taxed is crucial for managing expectations. Your bonus is considered supplemental income, and how it's taxed depends on your employer's method. There are two common approaches: Aggregate and Flat Rate.

Some states require employers to use the aggregate method. You get a bigger check upfront, but here's the catch – it might mean a higher tax rate in the standard withholding tables than your usual paycheck. This method is required in the following states:

Worried about your take-home pay? Use our Bonus Pay Aggregate Calculator for a quick estimate.

If you want to try it by hand, here are the steps:

1. Add the regular and supplemental wages together

2. Calculate the tax on that total amount

3. Subtract the tax withheld on the regular wages from the tax withheld on the total wages. The result is the supplemental tax amount.

1. Calculate the regular withholding of $3,456

Federal tax = $482.17

State tax = $146.39

2. Add up the total wages with the bonus

$3,456 + $400 = $3,856

3. Calculate withholding on total wages

Federal tax= $570.17

State tax = $165.99

4. Calculate the supplemental withholding: subtract the withholding on regular tax from the total tax

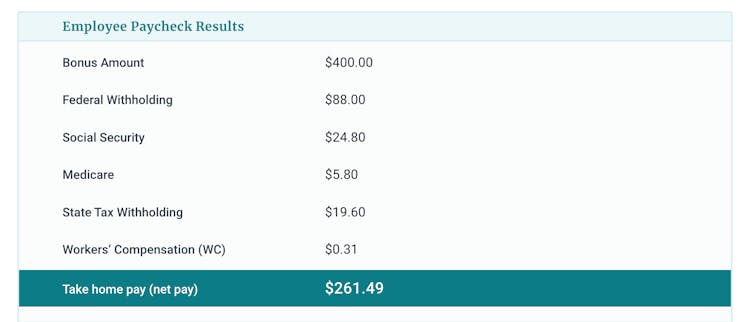

Supplemental federal tax = $570.17 - $482.17 = $88.00

Supplemental state tax = $165.99 - $146.39 = $19.60

Or to save time, you would go to the PaycheckCity Calculator and enter:

The flat-rate or percentage method is much simpler. Your bonus is not combined with your regular paycheck. Simply apply a flat 22% tax for federal withholding. States have their own rules for supplemental taxes. Use our Bonus Pay Percent calculator to see how much you will keep from this bonus! Simply write in your bonus amount and it will calculate your take-home pay.

To compare these two methods using our PaycheckCity Bonus calculators we will compare a $6,000 bonus in Georgia. The Gross pay is $50,000 with semi-monthly payments. Using these numbers in the calculator, the net pay using the flat rate is $4,101.00. The net pay using the aggregate rate is $3,841.08. That is almost half of your original bonus!

Got a bonus exceeding $1 million? The rules change a bit. The first $1 million is taxed at the regular rate. However, everything more than $1 million must be taxed at 37% for 2023/2024. So, if your employer uses the percentage method and you earn a bonus of $1,100,000, the $1,000,000 will be taxed at a flat 22% while the $100,000 will be taxed at 37%.

Supplemental bonuses include commissions, tips, overtime pay, vacation pay, sick pay and more. To avoid any surprises when your bonus check arrives, use our user-friendly calculators. Stay informed and plan your finances wisely as you head into the new year.

In the U.S., the average amount of working days in one year is 260.

Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. Here are four mistakes small business owners should avoid.

Celebrate National Payroll Week 2024, September 2-6! Join the fun, take the survey for a chance to win big, and honor payroll pros. Discover the joy of getting paid and learn more about this year’s theme: "America Works Because We’re Working for America ®."