How Many Working Days Are In A Year?

In the U.S., the average amount of working days in one year is 260.

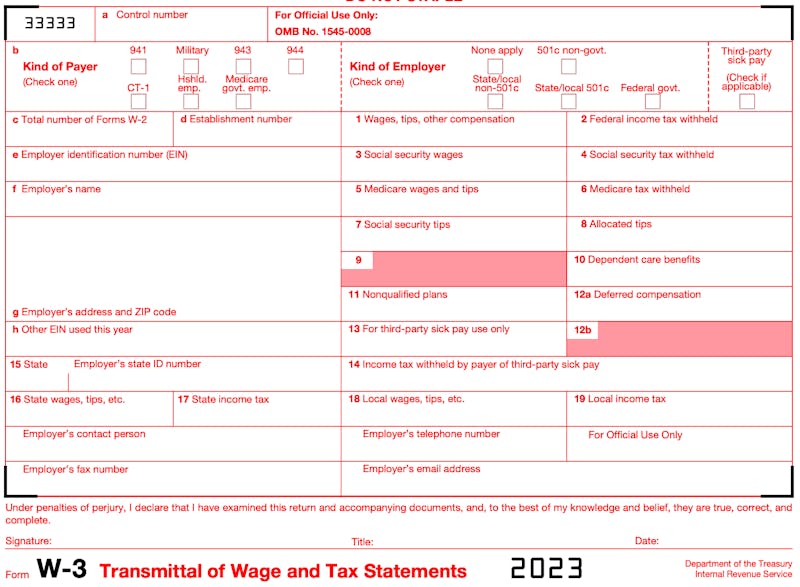

Don't let the W-2 and W-3 tax forms confuse you, understand the difference and file your taxes with confidence!

The W2 form, also known as the Wage and Tax Statement, is a form that is issued by the employer to the employee at the end of the year. It shows the employee's total wages earned for the year, as well as the amount of taxes that have been withheld from their paychecks. The W2 form is important because the employee uses it to file their personal income tax return.

On the other hand, the W3 form, also known as the Transmittal of Wage and Tax Statements, is a form that is submitted by the employer to the Social Security Administration (SSA) and the Internal Revenue Service (IRS). It summarizes the information from all of the W2 forms that the employer has issued to their employees. The W3 form is important because it allows the SSA and the IRS to verify the information on the W2 forms and make sure that the taxes have been reported correctly

In summary, the W2 form is issued to the employee, and it shows their total wages and taxes withheld for the year. Both forms are due to the SSA every year by January 31st and you can file electronically. The W3 form is submitted by the employer, and it summarizes the information from all of the W2 forms that have been issued to their employees. Both forms are important for different reasons and play a crucial role in the tax filing process.

It's essential to keep an eye on these forms and make sure that they are accurate and up-to-date. If you have any questions or concerns about your W2 or W3 forms, be sure to reach out to your employer or a tax professional for assistance.

In the U.S., the average amount of working days in one year is 260.

Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. Here are four mistakes small business owners should avoid.

Celebrate National Payroll Week 2024, September 2-6! Join the fun, take the survey for a chance to win big, and honor payroll pros. Discover the joy of getting paid and learn more about this year’s theme: "America Works Because We’re Working for America ®."